- Dividend Brief

- Posts

- A Prescription for Growth: This Dividend Stock Is Tapping a 40 Million-Patient Opportunity

A Prescription for Growth: This Dividend Stock Is Tapping a 40 Million-Patient Opportunity

When policy meets innovation, investors win.

A new Medicare agreement will bring this drugmaker’s obesity treatment to millions more Americans, unlocking powerful earnings momentum and long-term payout potential.

Read on for everything you need to know.

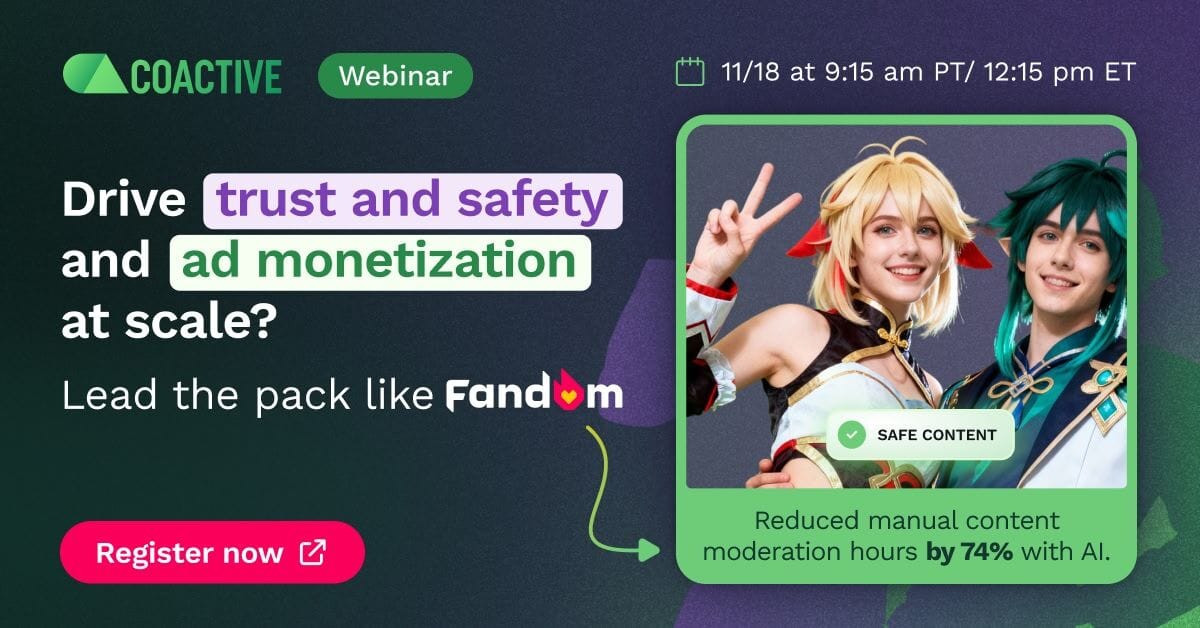

Fandom’s Winning Formula: Safer Content, 50% Savings, More Ad Revenue

The secret’s out.

Fandom—the world’s largest fan platform with 350M monthly visitors—faced a massive challenge: ensuring safety, quality, and monetization across 250,000 wikis.

Their solution? AI-powered transformation with Coactive.

Join our exclusive webinar on November 18 (9:15 am PT / 12:15 pm ET) to see how Fandom revolutionized content moderation and ad monetization.

Discover the results:

• 74% fewer manual moderation hours, boosting team morale

• 50% cost savings by automating image reviews

• Higher ad revenue from brand-safe, quality content

Learn how to turn your content into a monetizable growth engine that delights users and cuts costs.

Register today to join live or watch on demand.

Never Miss a Stock Recommendation Again!

We now send our dividend picks right to your phone via text, so you’ll get the same actionable moves without having to open your inbox.

Finance

Old Money, New Chain: JPMorgan’s Digital Flex

JPMorgan Chase & Co. (NYSE: JPM) has dropped its next big innovation play with the launch of JPM Coin, a blockchain-based deposit token that lets big institutions move money instantly through Coinbase’s Base network.

The project blends traditional banking precision with the borderless power of decentralized finance.

The system enables corporate clients to transfer digital dollars, backed by full fiat deposits held at the bank.

That means all the transparency of crypto without the chaos; a rare balance between speed, trust, and regulation that few institutions can claim.

Wall Street Meets Web3

For JPMorgan, this isn’t a crypto experiment; it’s a blueprint for what institutional money transfer could become.

Blockchain rails mean fewer intermediaries, faster settlements, and transactions that don’t take weekends off.

You can almost feel the shift happening as old financial engines adapt to modern code.

When the largest bank in America builds on-chain infrastructure, the rest of the industry takes notice and likely takes note.

The Bank That Codes Its Own Future

Global finance has always been about trust, but JPMorgan is proving that trust now comes with a ledger.

The bank’s embrace of tokenized deposits shows how legacy players can evolve without surrendering control.

You’re watching the banking system reinvent itself one block at a time.

And as institutions race to keep up, JPMorgan isn’t waiting for permission; it’s already rewriting the rules of money in motion.

JPM currently trades at $320 and pays a dividend of $6.00 per share, a yield of 1.88%.

Data Centers

Google Isn’t Expanding Servers - It’s Expanding Power

Alphabet Inc. (NASDAQ: GOOGL) is taking a bold step deeper into Europe with a €5.5 billion investment that turns Germany into its newest tech stronghold.

The plan includes a brand-new data center in Dietzenbach and an expansion of its Hanau facility, cementing Frankfurt’s status as a digital crossroads for Europe.

You can almost see the strategy unfolding; the company is building not just servers but a long-term foundation for the continent’s AI and cloud ambitions.

Demand for computing power is exploding, and Google wants to ensure it owns both the hardware and the headlines.

Europe’s Silicon Gateway

The project goes beyond cables and cooling towers. It’s a statement that Google plans to stay, hire, and help Europe modernize its digital backbone.

Thousands of indirect jobs, local contracts, and ripple effects will flow through the German economy as the investment takes shape.

When a company this size plants roots, you start to feel it across industries.

Whether you’re streaming, coding, or running enterprise AI, the odds are climbing that Google’s servers are quietly running your world.

Building the Future, Brick by Byte

Germany isn’t just getting new infrastructure; it’s getting a vote of confidence from one of the world’s biggest tech players.

The move fits neatly into Google’s global playbook of pairing sustainability with scale.

You’re watching a shift from search engines to engine rooms, where every watt of power fuels the next wave of AI.

Europe wanted digital independence; Google just gave it new machinery to make that dream real.

GOOGL currently trades at $286 and pays a dividend of $0.84 per share, a yield of 0.29%.

Must-See List (Sponsored)

Every once in a while, a few companies quietly shift the game.

Analysts are now tracking 5 emerging plays showing unmistakable growth signals.

Their momentum is building fast—and early investors are taking notice.

This exclusive list is free to view but only until midnight.

[See the full report here.]

*This free resource is being sent by Zacks. We identify investment resources you may choose to use in making your own decisions. Use of this resource is subject to the Zacks Terms of Service.

*Past performance is no guarantee of future results. Investing involves risk. This material does not constitute investment, legal, accounting, or tax advice. Zacks Investment Research is not a licensed dealer, broker, or investment adviser.

Entertainment

Hollywood’s New Power Couple Learns to Charge More

Paramount Skydance (NASDAQ: PSKY) is preparing for its next act, a Paramount+ price increase in early 2026.

It’s the first big swing since the $8 billion merger that married Paramount Global’s legacy with Skydance Media’s momentum.

The goal is clear: bankroll fresh content, upgrade the tech, and stretch the studio’s global reach.

The move tests just how much loyalty the merged giant can command in a streaming market where every dollar now feels like a vote.

You can feel the shift as the company moves from chasing subscriptions to chasing sustainable revenue.

When Two Studios Become One Machine

The merger wasn’t just about survival; it was about scale.

Paramount Skydance now controls everything from Nickelodeon to Showtime, giving it the kind of range that only a handful of rivals can match.

If you’ve ever wondered how Hollywood’s old guard keeps pace with digital-first competitors, this is the playbook: merge, modernize, and monetize every frame.

The studio wants to be everywhere your screen is, and soon, it might be.

Pay More, Stream Smarter

Raising prices is a risky move, but Paramount Skydance is betting that better content can offset the risk.

The company isn’t just aiming to charge more; it’s aiming to deliver more, from theatrical blockbusters to streaming exclusives that can anchor its new era of entertainment.

You’re watching the streaming wars turn into something more mature and far more competitive.

As 2026 approaches, Paramount Skydance isn’t hoping for a happy ending, and it’s writing its own sequel to profitability.

PARA currently trades at $16 and pays a dividend of $0.20 per share, a yield of 1.25%.

Dividend Stocks Worth Watching

Restaurant Brands International (NYSE: QSR) reported strong Q3 results last week, with Burger King playing a key role.

Building on that momentum, QSR has signed a deal with Chinese alternative asset manager CPE to manage Burger King’s growth in China.

The new joint venture will see CPE acquiring an 83% stake in Burger King China.

The company says it will invest an additional $350 million in sales and marketing, aiming to grow the number of Burger King locations in the country from 1,250 to 4,000 over the next decade.

QSR will retain a minority stake.

Restaurant Brands International currently pays a 62-cent dividend, yielding 3.59%.

Eli Lilly (NYSE: LLY) has signed a new agreement with the Trump administration to facilitate easier access to its GLP-1 weight loss drugs.

The company’s Zepbound injection, along with rival Novo Nordisk’s Wegovy medication, will be covered by Medicare from the middle of 2026.

This will significantly expand access to the obesity drug and could prompt other insurers to follow suit.

Eli Lilly says the new deal could see the number of Zepbound users increase from around 9 million currently to around 40 million patients.

LLY pays a 50-cent dividend, yielding 0.60%.

Toyota Motor Corporation (NYSE: TM) has confirmed a significant investment in its U.S. operations, with construction now underway in North Carolina on a $13.9 billion battery plant.

The new plant is the first-ever battery facility to be located outside of TM's native Japan, making it a massive coup for U.S. manufacturing.

The automaker has also increased its previous forecasted investment in the USA, saying it now expects to spend up to $10 billion more than planned over the next 10 years.

TM pays a semi-annual dividend with a yield of 3.33%.

Dividend Increases

AFL has increased its dividend to 61 cents per share, up 5.17%. Its new yield is 2.14%.

USEA has increased its dividend to 9 cents, a 200% increase. The new forward yield is 22.5%.

TYG has increased its dividend to 48 cents, a 30.14% increase. Its new yield is 13.14%.

GSL has raised its dividend to 63 cents per share, a rise of 14.29%. Its new yield is 7.21%.

Dividend Decreases

BAX has cut its dividend to 1 cent, a 94.12% decrease. The new yield is 0.22%.

WHF has reduced its dividend to 25 cents, a 35.06% decline. Its new yield is 14.81%.

Time-Sensitive (Sponsored)

A new report just revealed 7 stocks showing early signs of acceleration.

From thousands analyzed, only a select few passed the final screening.

Each one demonstrates strong earnings momentum and market leadership.

The method behind these picks has consistently spotted high-performing stocks ahead of the crowd.

The next move could unfold fast — get your free copy today.

*This free resource is being sent by Zacks. We identify investment resources you may choose to use in making your own decisions. Use of this resource is subject to the Zacks Terms of Service.

*Past performance is no guarantee of future results. Investing involves risk. This material does not constitute investment, legal, accounting, or tax advice. Zacks Investment Research is not a licensed dealer, broker, or investment adviser.

Trivia: What country uses the rand as its currency? |

Upcoming Dividend Payers

O’s ex-dividend date for the forthcoming 27 cents payment is 11/14/25.

ABBV’s ex-dividend date for the forthcoming $1.64 payment is 11/14/25.

COST’s ex-dividend date for the forthcoming $1.30 payment is 11/14/25.

SKT’s ex-dividend date for the forthcoming 29 cents payment is 11/14/25.

Everything Else

Disney’s seventh cruise ship, the Destiny, will launch from Fort Lauderdale, Florida, later this month on its maiden voyage. Disney's experiences segment is its second-highest revenue driver, making this a key launch, as the company expands its fleet at the fastest pace in its history.

Starbucks has been urged to return to the negotiating table by more than 100 members of Congress after talks with Workers United, which represents the coffee house’s baristas, stalled.

McDonald's has instructed its operators to remain focused on offering great value, as visits continue to decline.

That’s all for today’s edition of the Dividend Brief.

Thanks for reading, and if you have any feedback or dividend stocks you want me to take a look at, just reply to this email!

—Noah Zelvis

DividendBrief.com