- Dividend Brief

- Posts

- This Legacy Automaker Is Leaving Its Rivals in the Rearview Mirror

This Legacy Automaker Is Leaving Its Rivals in the Rearview Mirror

This automaker has driven one of the most decisive turnaround stories of the year.

While competitors wrestle with strategy shifts and rising costs, this market leader is delivering results, rewarding shareholders, and setting the stage for what could be another strong year.

Hidden Winners (Sponsored)

Most investors have never been shown this before.

Just before the Great Depression, a little-known market signal quietly began identifying historic winners—long before headlines caught on.

That same signal flagged several legendary stocks at prices that now seem impossible.

Now, with volatility rising again, it’s flashing green on three under-the-radar opportunities positioned to outperform into 2026.

Click here NOW — before it's too late.

Never Miss a Stock Recommendation Again!

We now send our dividend picks right to your phone via text, so you’ll get the same actionable moves without having to open your inbox.

Healthcare

Johnson & Johnson Drops $3B on the Future of Cancer Drugs

Johnson & Johnson (NYSE: JNJ) has completed a $3.05 billion all-cash acquisition of Halda Therapeutics, and the message is clear.

This is not about buying a single promising drug. It is about locking in a new way to build cancer medicines for years to come.

At the heart of the deal is Halda’s RIPTAC platform, built to target cancer-driving proteins inside cells using oral small-molecule drugs.

That matters because it brings you into a treatment model where pills are easier to take, easier to scale, and far more practical for long-term use than many injectable therapies.

A Platform, Not a One-Off Bet

Halda brings more than one program. Its lead prostate cancer drug is already in clinical trials, with earlier work underway in breast, lung, and other solid tumors.

The bigger prize is the platform itself. RIPTAC opens the door to discovering many future drugs, not just improving one.

That is how pipelines get deeper without constantly buying new companies.

Control Is the Real Advantage

By buying Halda outright, Johnson & Johnson keeps full control over development, timelines, and future uses of the technology.

There are no licensing limits and no shared economics down the road.

If this technology delivers, you are not just watching a $3 billion deal; you are watching the foundation of J&J’s next oncology chapter being built.

JNJ currently trades at $207 and pays a dividend of $5.20 per share, a yield of 2.51%.

Operations

The Skilled Trades Move That Could Change Retail Ops

Walmart (NYSE: WMT) is making a workforce move that goes far beyond perks or short-term labor fixes.

The company is rolling out a structured path that trains hourly associates into skilled trade roles, and the impact could reshape how Walmart operates over the next decade.

This is not about optics; it is about control.

You are dealing with a retailer that runs thousands of massive stores and distribution centers packed with automation, refrigeration, electrical systems, and robotics.

When those systems fail, you feel it immediately, because sales stall and costs rise fast.

Turning Store Staff Into Technical Backbone

Through its Associate to Technician program, Walmart is training existing employees for jobs like HVAC, refrigeration, automation, and facilities maintenance.

Instead of waiting for outside contractors, Walmart is building skills internally.

That means faster fixes, less downtime, and fewer disruptions, which you feel directly at the shelf and checkout.

Scale Turns Training Into an Advantage

Skilled trade shortages are a real problem across the U.S.

By developing talent from within, Walmart reduces hiring pressure, lowers long-term costs, and improves retention in roles where mistakes are expensive.

This strategy also changes how people view Walmart as an employer. Clear paths into higher-paying, technical roles improve loyalty and reputation.

As retail becomes more automated, the winners are those who can fix things quickly, and Walmart is building that edge quietly, one technician at a time.

WMT currently trades at $112 and pays a dividend of $0.94 per share, a yield of 0.84%.

Unseen Gains (Sponsored)

A dramatic transformation in the financial system is creating unprecedented wealth—but most Americans aren’t ready.

Traditional investing strategies may leave you behind.

Analysts who predicted past market crashes say a unique opportunity is forming right now.

One-person companies and innovative approaches are generating massive gains faster than ever before.

Access the Free Briefing

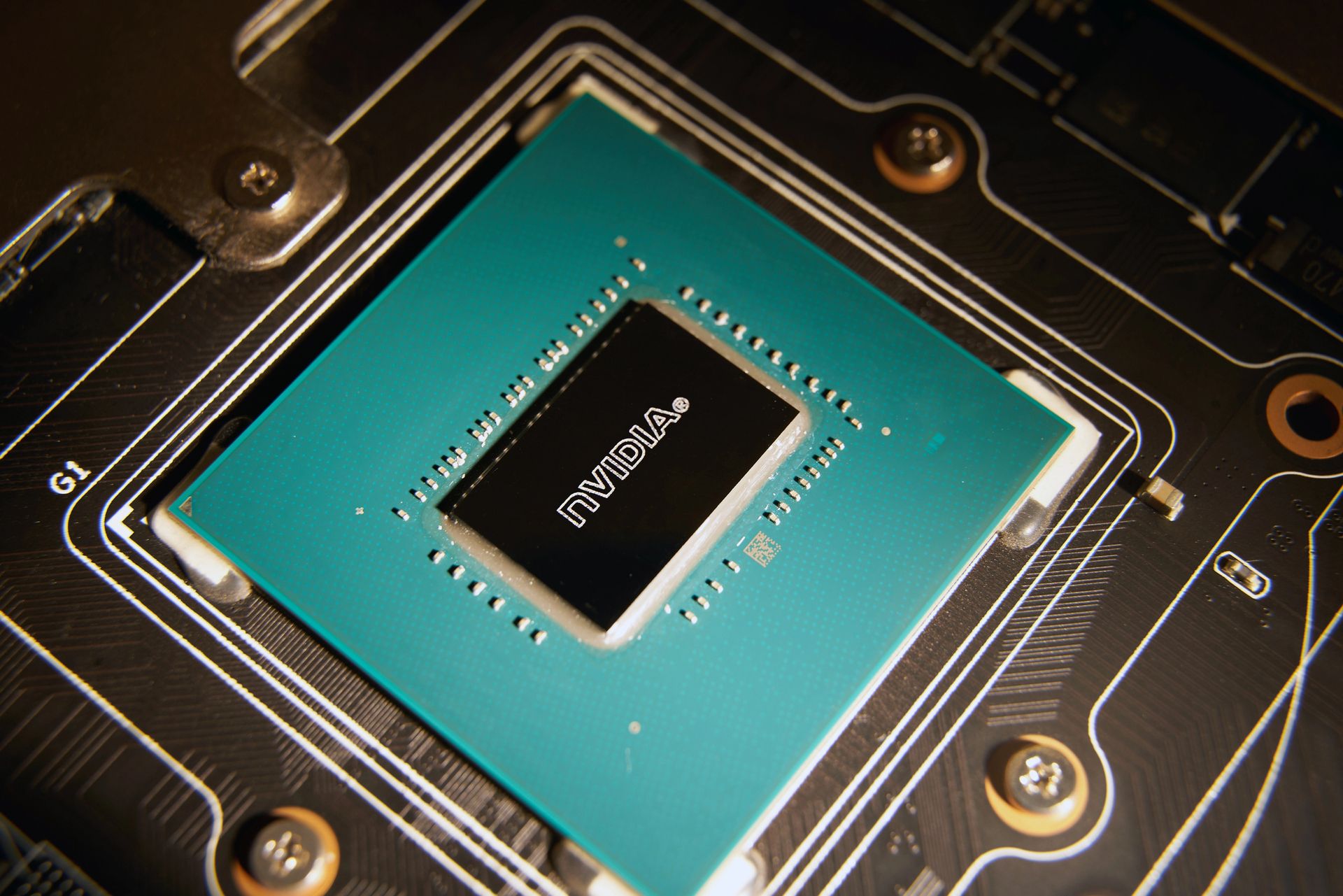

Semiconductors

Nvidia Eyes a $3B Move That Rewrites Its AI Role

NVIDIA (NASDAQ: NVDA) is in advanced talks to acquire AI21 Labs in a deal valued at $2-$3 billion, signaling a major shift in how the company plans to compete in artificial intelligence.

This would be one of Nvidia’s largest AI acquisitions and a clear step beyond hardware into the intelligence layer itself.

If completed, the move confirms what has been quietly taking shape. NVIDIA no longer wants to just power AI. It wants to help build the brains running on top of its systems.

Buying Brains, Not Revenue

AI21 Labs brings deep expertise in large language models, reasoning systems, and enterprise-focused AI tools.

The real asset is its roughly 200-person team, packed with elite researchers and engineers.

In today’s AI race, talent is scarce and expensive.

By bringing that capability in-house, Nvidia gains direct control over model design, training methods, and applied AI systems that can be tightly tuned to its hardware.

The Stack Starts to Close In

NVIDIA already dominates AI compute. Adding model builders enables alignment of chips, software, and intelligence into a single stack, where long-term advantage is created.

This also strengthens Nvidia’s enterprise push and its growing presence in Israel, a prominent AI talent hub.

If the deal goes through, rivals face a more challenging landscape in which Nvidia is no longer just a supplier but a direct competitor at the model level.

NVDA currently trades at $187.00 and pays a dividend of $0.04 per share, a yield of 0.02%.

Dividend Stocks Worth Watching

Diamondback Energy, Inc. (NASDAQ: FANG) is closing the year on a high with strong earnings growth and a significant new project close to its home base.

The Texas-based oil and natural gas company recently signed an agreement with Conduit Power to develop 200 megawatts of new natural gas power generation in West Texas, further expanding its influence.

Analysts have already tipped FANG as one of next year's best-performing energy stocks, thanks to its strategic position in the Permian Basin.

FANG pays a 56-cent dividend and has consistently increased its dividend payout over the last seven years. It offers a 2.69% yield.

Kinder Morgan Inc. (NYSE: KMI) and Phillips 66 (NYSE: PSX) will reopen sign-ups for the Western Gateway Pipeline in January after robust interest in the first round.

The Western Gateway Pipeline will connect upgraded existing pipelines and new infrastructure to provide a refined fuel route for western markets.

Fuel will be transported from Texas to Arizona, then to California.

KMI currently pays a 29-cent quarterly dividend, yielding 4.27%, while PSX pays a $1.20 quarterly dividend, yielding 3.73%.

General Motors Company (NYSE: GM) has emerged as the clear winner among US carmakers in 2025, with shares up more than 55% this year and recently pushing to a record high above $80 per share.

The rally – the firm’s best performance in almost two decades - has left rivals firmly in the rear view mirror.

Tesla has faced renewed pressure from softer demand and margin concerns, while Ford Motor Company continues to absorb the costs of its electric transition.

In contrast, GM has benefited from substantial truck and SUV sales, tighter pricing discipline, and a more measured EV strategy.

Looking ahead, expectations for 2026 remain constructive.

Wall Street analysts are increasingly optimistic on GM's cash generation, earnings resilience, and consistent delivery of shareholder returns, including ongoing stock buybacks.

That combination is reinforcing the view that the recent rally may have more runway left.

2025 Dividend Champions

CASY has outperformed its peers this year with a 49.65% annualized dividend growth rate. It has also reached 25 years of consecutive increases.

BEN has grown its dividend by a CAGR of 29.60%, with 46 years of consecutive increases.

BMI’s annualized dividend growth of 21.31% makes it one of the year’s top performers. It has raised its dividend each year for the last 33 years.

AFL has grown its dividend by 16.00%, and marked 44 years of consecutive increases.

2025 Dividend Losers

BAX slashed its dividend by 94.12% to just $0.01 per share in order to boost cash flow.

FMC cut its dividend by 86.2% to eight cents per share.

XRX dropped its dividend by 80.00%, cutting the quarterly payment to prioritize debt repayment.

Protect Your Portfolio (Sponsored)

Political transitions historically increase uncertainty—and this cycle is no exception.

Tariff expansion is reviving crash-risk conversations across Wall Street.

Asset protection strategies are gaining attention as volatility accelerates.

Ignoring structural risk has consequences during regime shifts.

Awareness precedes action.

No guarantees are implied.

This content is not a recommendation to buy or sell.

Download the FREE Presidential Transition Guide now.

Trivia: What year did the U.S. stop making half-cent coins? |

Upcoming Dividend Payers

MCK’s ex-dividend date for the forthcoming 82-cent payment is 01/02/26.

M’s ex-dividend date for the forthcoming 18-cent payment is 01/02/26.

NJR’s ex-dividend date for the forthcoming 47-cent payment is 01/02/26.

CTBI’s ex-dividend date for the forthcoming 53-cent payment is 01/02/26.

WMT’s ex-dividend date for the forthcoming 91-cent payment is 01/05/26.

GPC’s ex-dividend date for the forthcoming $1.03 payment is 01/05/26.

Everything Else

Louis Gerstner, who served as both CEO and chairman of IBM and was widely credited with securing the company’s survival in the 1990s, has passed away at 83.

Macy’s has confirmed plans to close its South Windsor, Connecticut, distribution center, resulting in the loss of 106 jobs, and to centralize operations in Columbus, Ohio, amid ongoing pressures.

Walmart has acquired a 2.4 million-square-foot, three-building industrial campus in Glendale, Arizona. It's the second-largest property sale in the area's history.

Meta has acquired the AI agent, Manus, for a rumored $2 billion. It is expected to incorporate the AI chatbot into its own tools, including Facebook and WhatsApp.

Lowes has capped a positive year of growth, with eight new and refurbished store openings and 800 new jobs created in 2025.

Despite slimming down its EV program at home, Ford is full steam ahead in China. The automaker has just launched a fully electric (BEV) and extended-range electric (EREV) Bronco for the Chinese market.

That’s all for today’s edition of the Dividend Brief.

Thanks for reading, and if you have any feedback or dividend stocks you want me to take a look at, just reply to this email!

—Noah Zelvis

DividendBrief.com